Books

Consider the Lobster and Other Essays (2005) by David Foster Wallace

DFW’s first collection of essays, A Supposedly Fun Thing I’ll Never Do Again, was some of the best nonfiction writing I’ve ever read, and this, his second collection of essays, is equally great. The topics covered include:

- His experience visiting an “adult entertainment” awards show in Las Vegas, exposing with sardonic wit how gross and nihilistic the entire porn industry and everyone involved in it is.

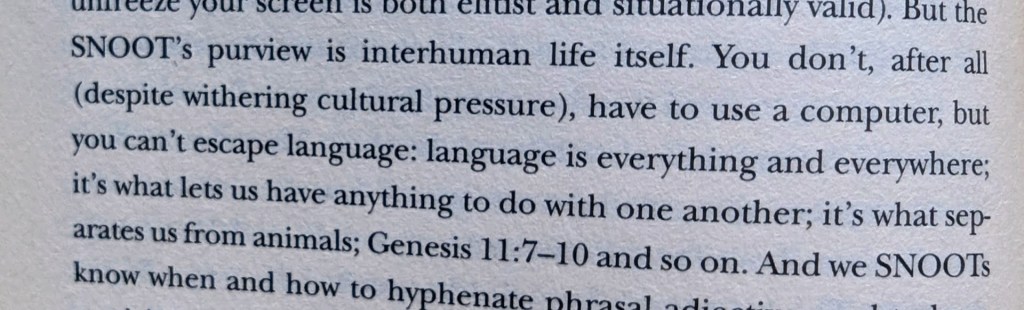

- A book review of a usage dictionary, which reveals why DFW is such a masterful writer, because of his obsession with words and the English language.

- About what life was like in the days following 9/11/2001 in Bloomington, Indiana.

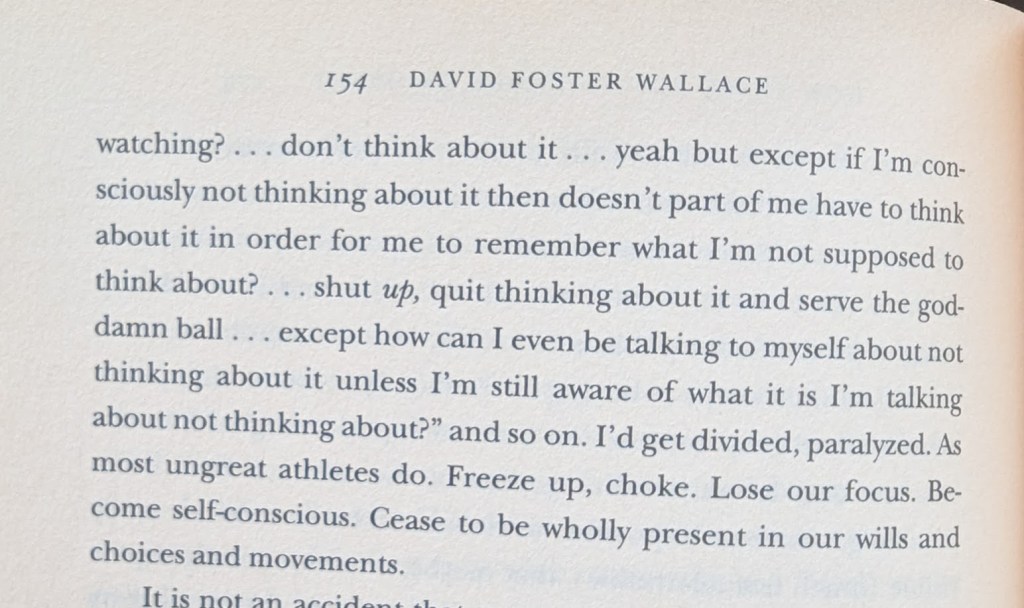

- A review of a memoir of a female child tennis star. Like I said last time, DFW can make any topic interesting, especially when writing about tennis, which was of particular interest to him.

- DFW’s experience following John McCain on the campaign trail during his 2000 presidential run, about the politician as a person in private versus how he presents himself to the public versus how the media presents him. Which is the real one? Is any of them “real“?

- His visit to the annual Maine Lobster Festival and the ethics of eating lobsters.

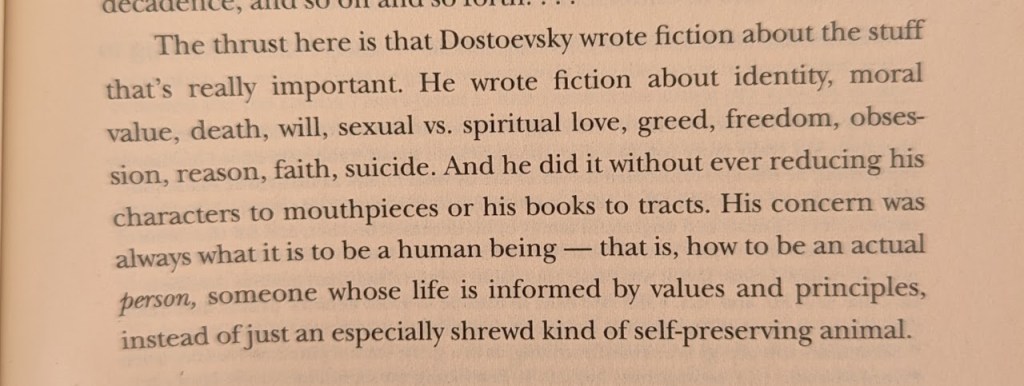

- A review of a biography of Dostoyevsky and his fiction—one literary master writing about another.

- A profile of a political talk radio show host in Los Angeles in the early 2000s, somewhat prophetic of podcasts and the decentralized media landscape that the internet would enable—yet it also now seems quaint. Like if you were worried about the political polarization of Bush-era talk radio, you had no idea what was coming… Plus this essay features the most convoluted set of DFW “foot”notes yet.