It seems fairly obvious at this point that AI is going to have a massive impact on the future. I wrote about this seven years ago, and it has only become more evident since then.1 However, financial “experts” are saying the stock market is in the midst of an AI bubble akin to the dot-com bubble of the early 2000s. They think AI companies are overvalued and advise selling off your AI investments. But the lesson from the dot-com bubble was not to NOT invest in internet companies. It was quite the opposite.

Sure, most internet companies during the dot-com bubble (like Pets.com) went bankrupt and became worthless. But the winners (like Amazon.com) turned out to be massively undervalued at the time. So even if this is an AI bubble in which most AI companies will go to zero, you should still be investing in AI because the winners will more than make up for the losers.

The problem is knowing beforehand which companies will be the winners and which will be the losers. It’s easy in hindsight to say you should have invested in Amazon when they are now a $2 trillion company. That is why you should place bets on as many AI companies as you can afford to—that is after doing your own research to determine which are the potential best AI companies and avoid those that are merely pump-and-dump scams.

During the dot-com bubble, companies would add “.com” to their name in hopes of drawing naive investors and boosting their stock price. Now companies are doing the same by adding “AI” to their name. So you must study each company to ensure they are actually doing something innovative and valuable before investing any money in them. The reason you should invest in many potentially great AI companies, even though some will inevitably lose, is because the downside of the losses stops at zero (assuming you don’t use leverage), but the upside of the wins is exponential. There is no limit.

If you invested $1,000 in Pets.com in 2001 amid the dot-com bubble, you’d have lost $1,000. But if you also invested $1,000 in Amazon.com at that same time, it would be worth over $435,000 today. You might say that was lucky to have chosen Amazon as one of your two investments.

So what if you instead invested $500 each into nine of the big dot-com companies amid the “bubble”: Amazon.com, eBay, Yahoo!, Priceline.com, Pets.com, Webvan, eToys.com, Boo.com, and WorldCom. More than half of those companies went bankrupt, so you would have lost $2,500 of your $4,500 investment on those losers. But who cares about the $2,500—because the $2,000 invested in the four winners would have turned into $1.25 million. That is, unless you got scared off by the dot-com bubble and refused to invest in all internet companies just because most of them were overvalued.

Earlier this year I read The Intelligent Investor by Benjamin Graham, considered by Warren Buffett to be the best book on investing ever written. In it, Graham outlined his strategy of “value investing,” which involves making safe investments in undervalued companies. He discouraged speculating on growth stocks because they are too risky. You can’t argue with the results of value investing, as Buffett used Graham’s methods to build his billions. The edition of the book I read was published with updated notes from financial journalist Jason Zweig in 2003, just after the dot-com crash. Zweig repeatedly chastised speculators for over-buying growth stocks during the dot-com boom, pointing to the subsequent crash as their inevitable punishment. But if those speculators simply held onto their losing stocks like Amazon, they would have eventually turned into massive winners twenty years later. Two of Buffett’s keys to success in investing are patience and time. Investors need to think in decades, not days.

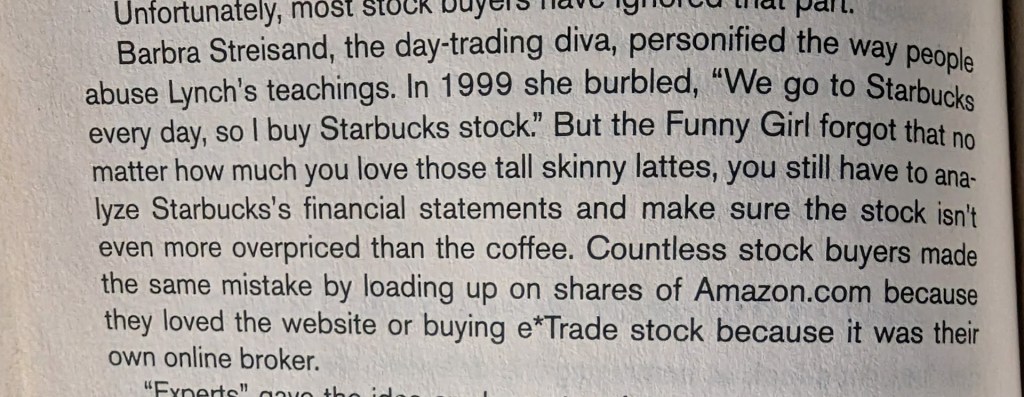

Yet see this snarky note from Jason Zweig:

Who’s laughing now? If Barbara Streisand held on to her $3 Starbucks shares in 1999, she would be quite rich today (SBUX @ $87). And if you were one of the “fools” who bought Amazon at the peak of the dot-com bubble when its stock price soared to $5.65 before later crashing to $0.28, you’d be even richer, with AMZN now at $225.2 Looks like the “Funny Girl” got the last laugh.3

Far be it from me to disagree with investing legends like Buffett and Graham, but I think the equation has changed since The Intelligent Investor was published in 1949 (and Buffett’s prime years of the 1970s).4 The internet that was being hyped during the dot-com bubble eventually did pay off. The internet has fundamentally changed everything, enabling technological growth companies to scale much larger and much faster than businesses of the past. And AI will enable companies to grow even larger and faster in the future. If you avoid speculating on growth companies because they are too risky (and they are legitimately risky), you will lose out on the biggest potential wins. Due to Buffett’s cautious value investing principles, he missed out on Google, a decision he later regretted and considers a mistake.5 The next Google will be an AI company (and it may be Google itself).

So are we in an AI bubble? Yes.

Are most AI companies currently overvalued? Yes.

Should you stop investing in AI companies? No.6

Even if the AI bubble crashes within the next two years, the AI winners will persevere over the next two decades.

- In 2017, I put my money where my mouth was and invested in what I thought was the leader in AI at the time (Google), which has grown over 400% since then. ↩︎

- These prices are adjusted for later stock splits. At the time, AMZN was $113 at the peak in 1999, then sank to $5.51 at the low in 2001. One share of AMZN bought at its 1997 IPO of $18 would be worth over $54,000 today. (I am able to quickly cite these price adjustments thanks to AI.) ↩︎

- While not directly related to AI, I also invested in Amazon in 2017 (though I wish I had invested in AMZN a decade and a half earlier during the dot-com “bubble”). ↩︎

- Though Graham’s 1949 book has still aged better than Zweig’s 2003 notes. ↩︎

- Buffett said he passed on Google because he did not understand the technology. This does not mean he should have invested despite not understanding the technology (nor should you); he should have learned about the technology. The same with AI now. Spend time learning about the technology behind AI before investing in any AI company, or else you may end up owning the AI equivalent of Pets.com instead of Amazon. ↩︎

- DISCLAIMER: This is for general informational purposes only and should not be interpreted as personalized financial advice, investment recommendations, or a solicitation to buy or sell securities. ↩︎